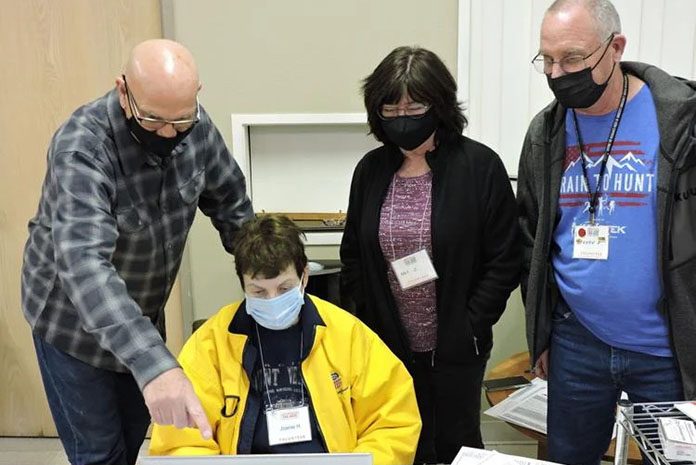

The AARP Foundation Tax-Aide program is available beginning in February in Hermiston and Lexington.

People do not have to be an AARP member to utilize the service. While the focus is to provide help to older adults with low to moderate income, others may utilize the program. In Hermiston, services are provided in English and Spanish; and English only in Lexington.

IRS-certified volunteers will prepare federal tax returns that fall within the scope of their training, which includes most items on Form 1040. Some areas not covered include rental property income (except land only), farm income, certain income items on Schedule K-1, moving expenses, casualty and theft losses, the Alternative Minimum Tax and loss from a self-employment business.

Appointments, which are required, are available on designated days from 8:30 a.m. to 2:30 p.m. Local sites:

• New Hope Community Church, 1350 S. Highway 395, Hermiston (Tuesdays and Wednesdays, Feb. 6-April 10).

• Lexington Town Hall, 425 F St. (Select Fridays, Feb. 2-April 12).

Participants need to bring all 2023 tax documents, including the previous year’s tax return. Also, photo identification and Social Security cards are required for everyone on the return.

To register, leave a message at 541-701-9326. For questions, email Bobbi Gordon at bgordon.aarp.taxaide@gmail.com. For more information, visit www.aarp.org/money/taxes/aarp_taxaide.